“Chance favors the prepared mind” - Louis Pasteur

Strategic thinkers are considering IPOs. Why?

Partners exit at a multiple.

Options attract new hires.

Interim equity grants reward high achievers.

Firm members access interim liquidity and personal borrowing potential.

Long-term expansion funded with long-term capital.

Freedom from client payment timing.

Self-fund contingent cases without diluting successful outcomes.

Michael Kane describes a common-sense way to improve the value of your IPO in a deal underwritten by Major National Investment Banking Firms.

It’s not a question of “whether.” It’s a question of “when.” A frozen river melts slowly…. until one day, it all gives way into the torrent.

DLJ going public was a “one-off” among private investment banking partnerships until it wasn’t. “Attorney Advertising” was tightly circumscribed until it wasn’t.

The law firms that are first and early to do an IPO can set the bar for public market valuation - for themselves and the industry.

IPO “success” is not merely “getting the deal done.” It’s achieving your company's optimal stock trading range during (and sustaining it long after) the IPO.

Permit me to introduce the concept of: “Capital Markets Branding.”

It’s the image of your company that governs investor perception of value in the public equity capital market.

If you run the IPO process without giving any disciplined thought to this, you are letting valuation “happen to you.” You are squandering your responsibility to yourselves and your stakeholders to engineer an optimal sustainable valuation.

Your Capital Markets Brand is what securities trading desks call your “story.” The early industry entrants into the public capital markets have the greatest potential and the biggest blank canvas for influencing market perceptions of industry and individual firm equity trading values.

Your story is an encapsulation of key elements, such as:

Your commercial identity and brand quality, business model, service mix, pricing, recruitment, client acquisition, and growth strategies. You get points for originality, creativity, predictability, and empirically validated, superior financial operating performance.

If you are smart, you configure, describe, present, and test your capital markets brand - to tune it to the most convincing effect on the intended institutional investor audience.

You figure out your optimal capital and voting structure and configure your IPO deal to fit.

Then, you interview the best underwriters for your company and deal structure. It’s meritocracy, not entitlement. You tell the underwriters you are going public; you don’t ask. You tell the underwriters your value story and the valuation it supports; you don’t ask. You DO ask whether they can buy in, or not — confirming that you are also interviewing others objectively as qualified as they are to lead your deal.

Who am I, and how do I know this? I am Michael Kane, and I have served as lead banker among managing underwriters and, as a lawyer, served as both company and underwriters’ counsel. More importantly, I learned how to design and sell business equity for the highest obtainable yield over the last three decades, doing scores of deals, evaluating hundreds more, and interviewing thousands of executives. It’s been my life’s work.

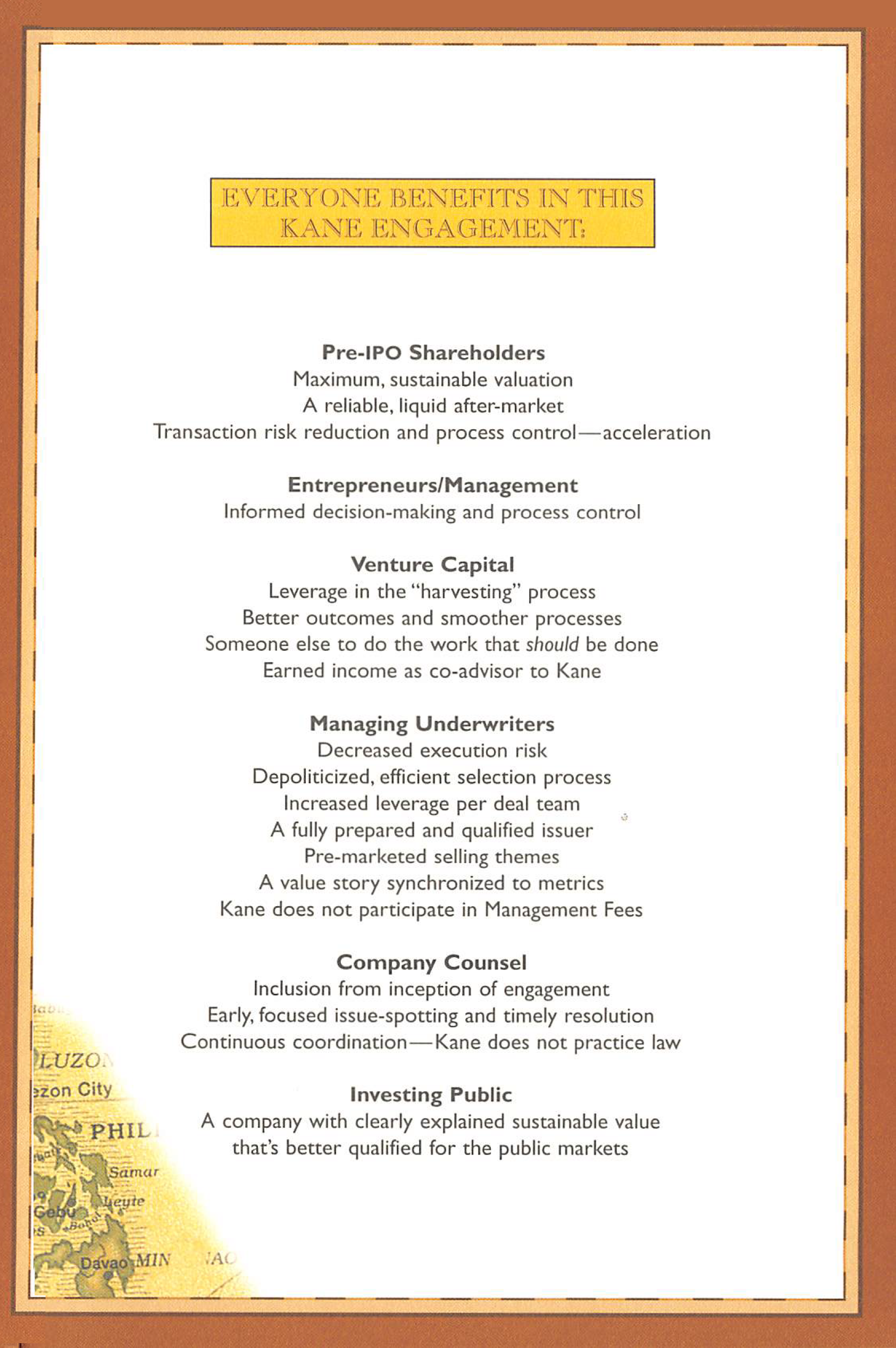

I founded Kane & Company in 1991 as an SEC-registered Private Investment Bank (Member: FINRA/SIPC) because I thought companies going public needed an unconflicted, empowered valuation guru and a proponent in the IPO process. I developed an engagement type recognized by FINRA called: “Planning, Preparation and Project Management of IPOs.” Engaging my firm for this role did not displace any Big Bank underwriter - rather, it attracted the best Big Bank underwriters and laid the foundation for them to succeed for you. Please note that the testimonials at the bottom of this page are from Big Bank underwriters.

I started on Wall Street as a technology banker for L.F. Rothschild in New York, and ultimately rose to Head the Technology Investment Group of CIBC Oppenheimer. Before that, I practiced M&A and securities law for Irell & Manella in Los Angeles, was the 6th hire for the start-up that became DirecTV, and was a Project Leader in the Systems Sciences Department of The Rand Corporation.

If you are intrigued by the possibilities, for best results we must begin positioning and preparing your firm at least a year before any potential IPO. But first, we should meet and talk about it so you can Ask Michael Kane.

You are directly accountable to stakeholders. (The underwriters move on to the next – you live with the results forever.) To improve your outcome reliably, talk to Michael Kane.

Arrange a 15-minute Zoom meeting with Michael to discuss the most effective approach for solving your challenge.

-

Kane & Company manages your deal. Success Compensation Structure.

-

Michael Kane coaches you 1-on1 through your process. Flat monthly fee.

-

Orientation Seminars to teach your team about an upcoming transaction and how best to contribute by role. Flat fee by company or by participant

-

Stream video courses orienting you to how a business sale, IPO, Merger, Acquisition, Restructuring, work for those who will be accountable for outcome. Priced individually or in bundles.

-

Weekly live Q&A sessions about any topic - investment banking related. Offered as a monthly subscription with a liberal cancellation policy.

Not sure what you are ready for, but do you have a burning question in the meantime?

Open Topic weekly live “Office Hours” session subscription series

Burning questions “right now;” linear course or seminar is too much or too slow

Ask Michael Kane about how investment banking deals work

Anytime access via AI bot to our accumulating knowledge base, vetted for accuracy - a privilege of series membership

Liberal cancellation policy.

Stay connected, learn more, and retain access to the proprietary AI Knowledge Base.

Let’s determine how to improve transaction results for you and your stakeholders by exploiting three decades of experience. We can meet you at your level of sophistication - whatever your experience base.

What They Say

"I have found Kane & Company to be very knowledgeable and competent in evaluating companies … to determine optimal equity market value and for preparing companies to execute transactions designed to realize that value." - Technology Research Analyst - Nationally-Recognized Underwriter

“Kane & Company serves a very useful niche as a co-manager in our industry… the firm is especially good at evaluating companies to determine the appropriate transaction for an individual company and then assembling the most qualified underwriting team to execute the offering.” - Head of Technology Investment Banking - Nationally-Recognized Underwriter

"The Kane team has made a significant difference in maximizing the value to the client company on which we worked…helping foster superior returns to investors." Technology Research Analyst - Nationally-Recognized Underwriter, subsequently Venture Investor

"The advantage of working with Kane now, before you are ready to begin the public offering process, is that Kane will not recommend us to you if Kane believes that we are obviously mismatched along any number of dimensions important to our evaluation process…" Lead Investment Banker - Nationally-Recognized Underwriter